Top Bitcoin Mining Industry News of the Week

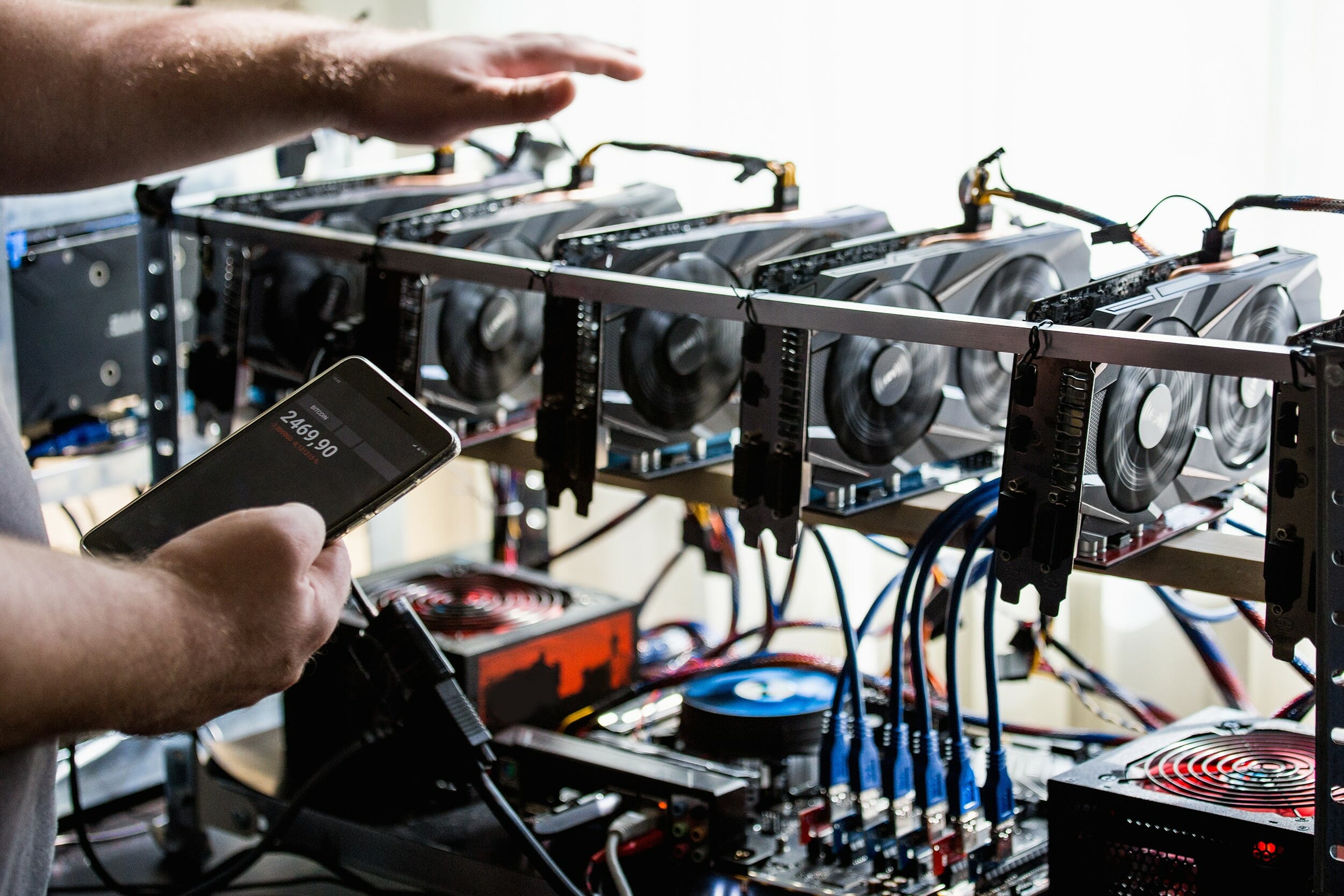

There has been a significant amount of movement in the hard-hit bitcoin mining industry.

A new week closes in the turbulent world of cryptocurrencies and this market has behaved markedly volatile. In particular, it should be noted that the consequences of the halving can still not be considered a past affair. The latter, above all, visualizes that the BTC price remains in a neutral to negative position. Mining company profits remain remarkably low in this environment.

At the same time, the cost of production of each BTC continues to be well above the spot market price of the coin. Thus, many companies find it more profitable to provide AI-related services and buy BTCs with the proceeds.

Miners’ Capitulation Continues to Plague the Industry

The bad moment in the mining sector is spreading. Although the halving of the bitcoin price seems more and more distant, its effects continue to create chaos in the industry. This is compounded by the weak spot price of bitcoin and the increasing difficulty of networking due to new ASIC connections.

Among the miners, especially the small and medium ones, the combination of these elements leads to a high capitulation rate. This week, due to the constant problems with the BTC price, the rate was particularly high.

AI to the Rescue of the Digital Mining Sector

All is not lost, despite the problem of capitulation and low returns in the bitcoin mining industry. By providing AI-related services, large companies have found an alternative. Mining companies are using their resources to increase their profits, as there is a huge demand for the computing power of artificial intelligence.

It is worth looking at a recent report from VanEck to get an idea of this huge window that is opening up for the mining sector. Miners stand to make $38 billion from the AI market, according to this financial firm.

Over the next 13 years, they could earn more than $13.9 billion per year. A 20% shift in computing power from mining to AI and HPC services would do it all, they explain.

Mining Profitability Hits New Record Low

Without AI alternatives, mining companies are stuck in a dead-end situation. Praying for the price of bitcoin to rise in the coming months is one of the few hopes. Medium and small companies could stop surrendering if the currency’s exchange value exceeds the production price.

In any case, according to Bitbo data, the profitability of the sector has recently reached a new all-time low. JPMorgan Bank, on the other hand, points out that despite the increase by half, the hash price is still far from its pre-capitulation level. In this respect, it is about 30 EH/s lower than it is now. The hash price is 30% below its December level. It is -40% below its pre-halving level.

Mining Sector’s Hash Capacity Increases, But So Does the Bad News

The bitcoin mining industry has no choice but to run for the future. For companies, bad times in returns can only improve with expansion. That’s what the most capable companies do.

The computing power of mining companies is steadily increasing, according to data from CryptoQuant cited by the media. Large companies are trying to offset the decline in profitability with this increase in new equipment connections.

In spite of this, the cost of producing a BTC is still much higher than the price of the coin. This means that the sector is still operating at a loss. What would be worse, however, would be the cessation of expansion.

By Leonardo Perez