SEC Sues Crypto Mining Company for Misappropriation of Investor Funds, and other News

The SEC filed the lawsuit due to well-founded suspicions of financial misconduct by Geosyn.

The United States Securities and Exchange Commission (SEC) has filed a lawsuit against crypto mining company Geosyn and its co-founders. In it, they are accused of misappropriating $5.6 million from investors. The defendants, who include CEO Caleb Joseph Ward and former COO Jeremy George McNutt, are being targeted for fraudulent activity and misleading investors.

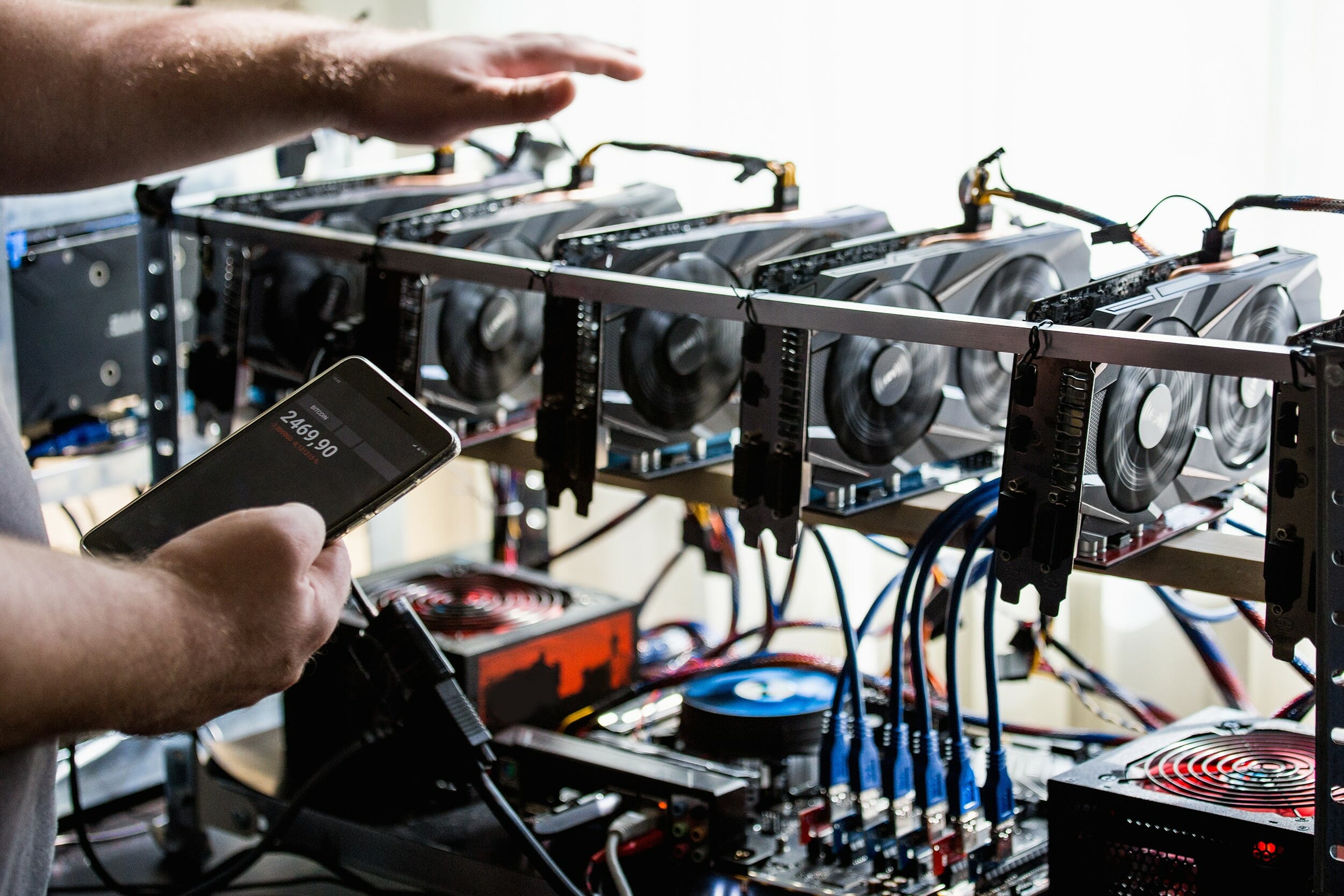

Geosyn allegedly deceived 64 investors between 2021 and 2022. The company promised to buy, maintain and operate cryptocurrency mining machines to distribute cryptoassets such as Bitcoin in exchange for a fee. However, according to the indictment, Geosyn failed to deliver on these promises.

The legal document maintains that the company did not acquire or operate the equipment necessary to carry out the promised mining. Of the 1,400 machines that were part of the investment plan, 400 were never purchased and those that were acquired mostly remained inactive. Furthermore, Geosyn restricted its mining activities exclusively to Bitcoin, despite having promised investors a broader range of cryptocurrencies.

United Kingdom Expands Powers to Fight Cryptocurrency Crime

The National Crime Agency (NCA) and the UK police have been given new powers to “seize, freeze and destroy” cryptocurrencies linked to criminal activity. With these measures, authorities will be able to act more quickly and efficiently to combat the use of digital assets in crimes.

The new rules allow police to seize cryptocurrency assets without making a prior arrest. Which facilitates actions to prevent criminals from hiding their illicit profits. Additionally, law enforcement may confiscate cryptocurrency-related items, such as passwords and USB drives, to support their investigations.

Another key provision of the new laws is the ability of police to remove digital assets. Additionally, seized cryptocurrencies can be transferred to wallets controlled by authorities. Allowing victims of crime to request the recovery of funds that have been stolen from them.

Yuga Labs Announces Restructuring with Staff Cuts

Yuga Labs, the Web3 giant known for its non-fungible token (NFT) collection, has announced a restructuring that involves cutting several members of its team. Co-founder and CEO Greg Solano shared the news in a memo posted on social media last Friday.

“Today is a really hard day,” Solano said regarding the difficult decision to restructure the company. «I am committed to transforming Yuga and returning us to our roots, and that means making difficult decisions. The most difficult one, that is, saying goodbye to some talented team members,” he added.

The change in direction comes after a period of rapid expansion for Yuga Labs, which had seen significant growth in the NFT market. Solano stressed that the company “lost its way” and that the new approach will focus on building “a more agile and focused team.”

Hong Kong Approves Bitcoin and Ethereum Spot ETFs, but China Remains Out of Market

The recent launch of Bitcoin and Ether spot exchange-traded funds (ETFs) in Hong Kong will not open the market to mainland Chinese investors, Bloomberg data analyst Jack Wang explained. All this, during a Web seminar dedicated to this recent approval.

Hong Kong approved the first Bitcoin and Ethereum spot ETFs, established by three Chinese asset managers, China Asset Management, Harvest Global Investments and Bosera, through their subsidiaries in the region.

However, despite these close ties to the mainland, these funds will not be available to mainland Chinese investors. Wang cited a Chinese State Council statement issued in September 2021, which prohibits financial institutions from creating accounts, transferring funds or providing compensation for any cryptocurrency-related transactions.

By Audy Castaneda